Disney Star and Viacom 18 steady TV and virtual rights for IPL 2023-2027 in a ancient $6 billion deal, setting new records in sports broadcasting.

The Indian Premier League (IPL) has once again set a record with its media rights auction for the 2023-2027 cycle, in addition solidifying its reputation as one of the wealthiest sports activities leagues globally. The IPL’s blockbuster media rights deal, well worth INR 48,390.5 crore (about US$ 6.2 billion), has raised the bar for the sports broadcasting world, making the league the second most valuable in term of per match value, only behind the National Football League (NFL).

The auction saw intense bidding multiple categories for both domestic and international broadcasting rights, culminating in a history agreement that signals the growing importance of digital media and the increasing shift online viewership in India.

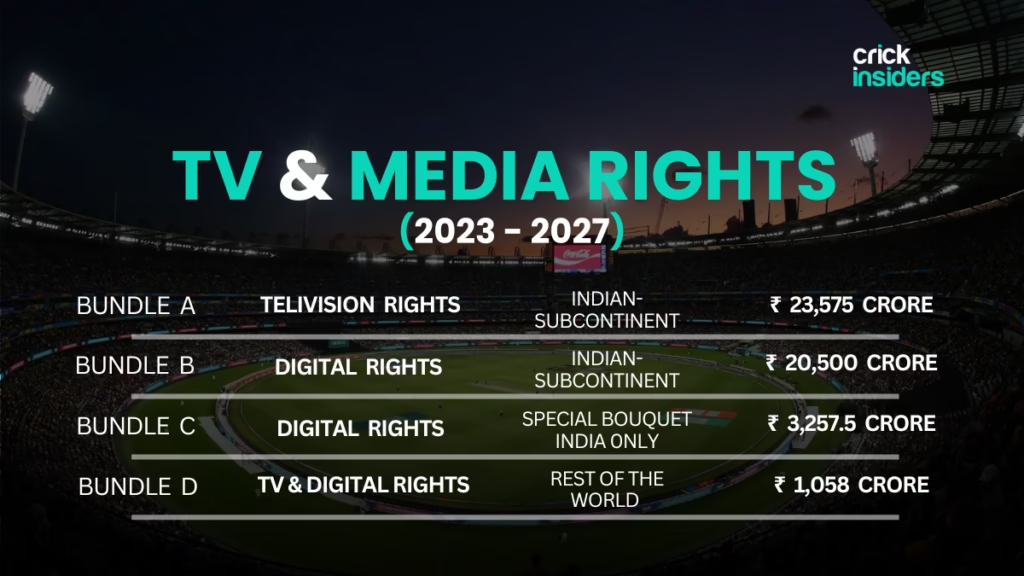

TV and Digital Rights: A Split Between Major Broadcasters

The IPL’s media rights were split between two major broadcasters: Disney Star and Viacom 18. Disney retained the TV rights for the Indian subcontinent, with a bid of INR 23,575 crore (around US$ 3 billion). On the other hand, Viacom 18 secured the digital rights for the subcontinent and media rights throughout three key global regions—Australia and New Zealand, the UK, and South Africa—for a similar amount, INR 23,758 crore (approximately US$ 3 billion). The deal additionally included media rights for 2 additional regions— the Middle East (INR 205 crore) and the us (INR 258 crore), which have been presented to Times Internet.

This deal marks a shift in the broadcasting panorama, with digital rights gaining significant. Viacom 18’s bid for the digital rights, which amounts to INR 50 crore (approximately US$ 6.4 million) per match for standard package, is one of the using forces behind this dramatic increase in the IPL’s value. In addition, Viacom 18’s additional commitment to acquiring high-profile games, together with playoff matches and finals, will see them paying a complete of INR 58 crore (approximately US$ 7.43 million) according to match.

A Massive Jump in Per-Match Value

The IPL’s media rights for this cycle have witnessed a remarkable, nearly tripling the value of the previous deal. The general price of INR 48,390.5 crore for the 2023-2027 cycle is 2.96 times higher than the previous IPL rights deal for 2018-2022, which became well worth INR 16,347.5 crore (around US$ 2.55 billion).

The increase in per-match cost is astounding: The per-match cost for TV rights is INR 57.5 crore (about US$ 7.36 million), while the digital rights have crossed INR 50 crore (about US$ 6.4 million) per-match. Viacom 18’s general bid for high-profile games, which includes a non-exclusive package deal, will take the effective price for those games to just over INR 58 crore (approximately US$ 7.43 million).

This jump in value is reflective of the growing viewership and sponsorship demand for IPL, with the tournament’s increasing global appeal. The IPL’s increasing per-match value now places it in behind only the NFL in terms of value per game, highlighting the enormous growth potential for the league.

Rising Importance of Digital Media within the Indian Market

The digital rights have proven to be the maximum beneficial class in this media rights auction. Viacom 18’s winning bid for the digital rights in the subcontinent alone was 13% higher than the overall bid made by Star India for the global consolidated rights (TV and digital) in 2017. In fact, digital rights in the IPL have seen a meteoric rise in the recent years. For comparison, the best bid for digital rights in 2017 was INR 3,900 crore (approximately US$ 0.61 billion), which was eventually outbid Star’s consolidated offer.

The auction has seen a 51.5% increase in the bid for digital rights in comparison to the base price set to the IPL. Additionally, the price for the special non-exclusive package of high-profile games has soared by 108% from its base price.

BCCI Secretary Jay Shah attributed this surge in virtual rights valuation to the rise of virtual viewership in India. He noted that during 2017, there were round 560 million digital viewers, which increased to 665 million in 2021. By 2024, it’s far predicted that India may have 900 million internet users, signaling an even more significant shift toward digital consumption of content. The IPL, consequently, stands to gain greatly from this growing digital audience, a factor that has driven the auction prices up to extraordinary level.

The Future of IPL’s Broadcasting Landscape

The IPL’s media rights deal is ready to revolutionize the broadcasting landscape, each in India and globally. The strategic split between TV and digital rights is a clean reflection of the growing importance of digital platforms, which have taken center stage in the wake of the rapid shift toward online viewership. With the rise of systems like Viacom 18’s virtual carrier, if you want to have the rights to stream the complete IPL event in the subcontinent, fans now have more access to the league than ever before.

Digital platforms are getting increasingly central to the sports activities broadcasting industry in India. Given the growing numbers of mobile users and internet penetration, the IPL is nicely-positioned to benefits the growth in digital viewership. The league’s widespread appeal across various demographics—mainly more youthful audiences—makes it an ideal fit for digital systems, which allow for more flexible and interactive content consumption.

Meanwhile, Disney Star’s retention of the TV rights ensures that traditional tv audiences will still have access to the games. This dual approach helps in catering to the needs of a desires viewership base, combining the reach of tv with the flexibility of digital platforms.

The Financial Implications for IPL Franchises

While the BCCI stands to gain benefits from the sale of IPL’s media rights, the franchises themselves also are set to gain a massive financial windfall. With the central revenue share has set to rise significantly, every IPL franchise will receive of an envisioned INR 500 crore annually, up from the previous cycle’s figure of about INR 370 crore. This increase in revenue will allow the franchises to invest more in player acquisitions, infrastructure, and fan engagement, leading to an even more competitive and entertaining IPL season.

In end, the 2023-2027 IPL media rights auction has been a powerful fulfillment for each the BCCI and the IPL franchises, with a report-breaking deal that sets a new benchmark for sports broadcasting. As digital media keeps to grow in importance, the IPL is well-placed to experience the wave of increasing online viewership, while also maintaining its traditional TV audience base. With the league’s financial clout now stronger than ever, the destiny of the IPL looks highly promising, each as a sporting spectacle and as a business entity.

Key Takeaways from the IPL 2023-2027 Media Rights Deal:

- Record-Breaking Valuation: The overall deal is worth INR 48,390.5 crore (approx. US$ 6.2 billion), making it one of the wealthiest sports broadcasting offers in the world.

- Split Between TV and Digital Rights: Disney Star secured the TV rights for INR 23,575 crore, at the same time as Viacom 18 secured the digital rights for INR 23,758 crore.

- Per-Match Value Soars: The cost per-match has nearly tripled compared to the previous deal, with TV rights priced at INR 57.5 crore per-match and digital rights at INR 50 crore per match.

- Growing Demand for Digital Rights: Digital media has emerged as key growth driven for IPL’s media rights, with virtual bids exceeding conventional TV rights in value.

- Revenue Boost for IPL Franchises: The deal will provide a substantial increase in central revenue for IPL franchises, with each franchise set to obtain around INR 500 crore annually.